As new financial year starts on 1 April of every calendar year, some business firms prefer to continue with the same books of accounts and some prefer to start with fresh books. On Taxperts a business can use any of the options that is either follow the same book with updated voucher configuration or to switch to fresh books in new financial year.

Your Comprehensive Financial Solution Taxperts Software

HOW TO SWITCH TO NEW FINANCIAL YEAR? (FOR ONLINE VERSION ONLY)

Method 1: Use same books for all financial years.

If wish to continue with same books of accounts, you should following steps:

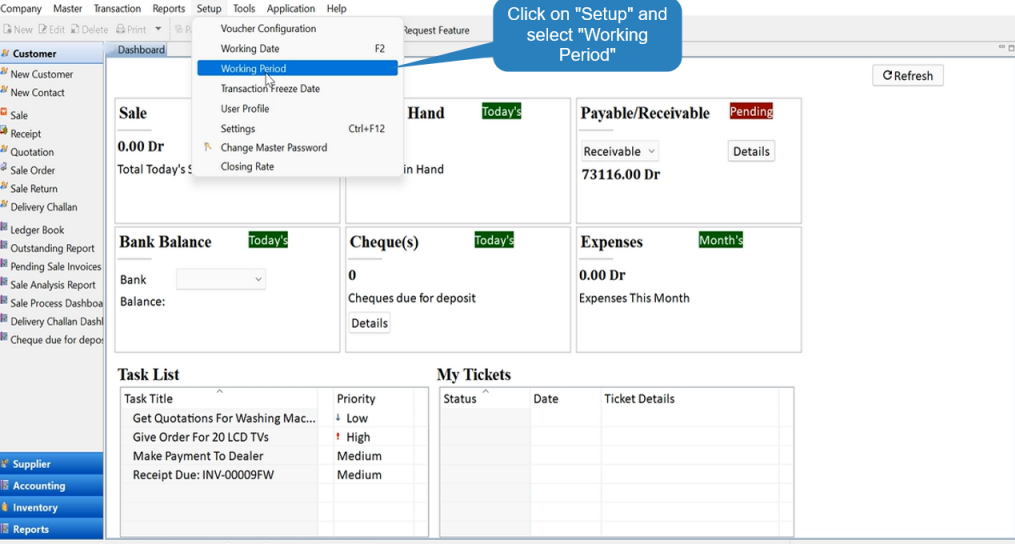

Step 1: In Taxperts software login to your company. Go to Setup , Select Working Period.

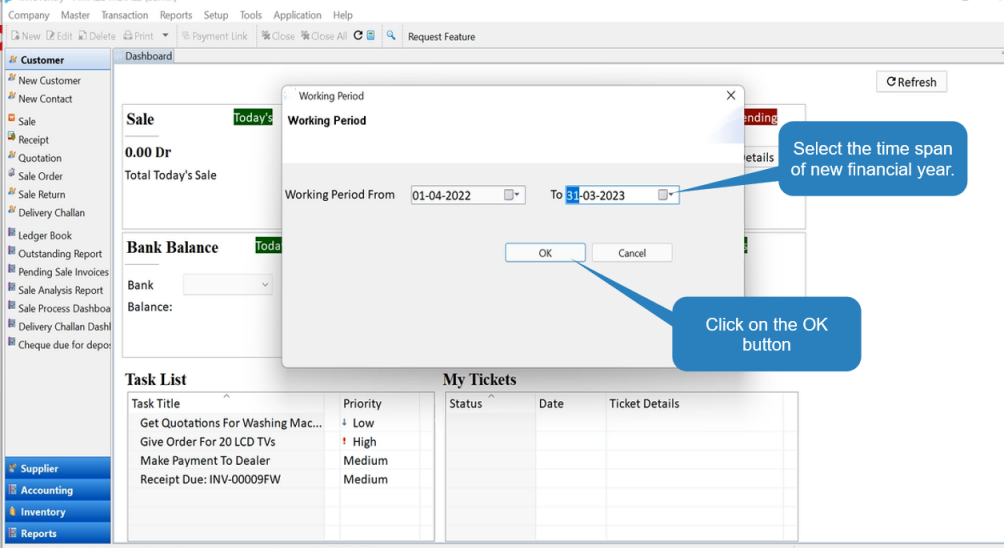

Step 2: Change working period to 1/04/2022 to 31/03/2023 and Click on “OK”.

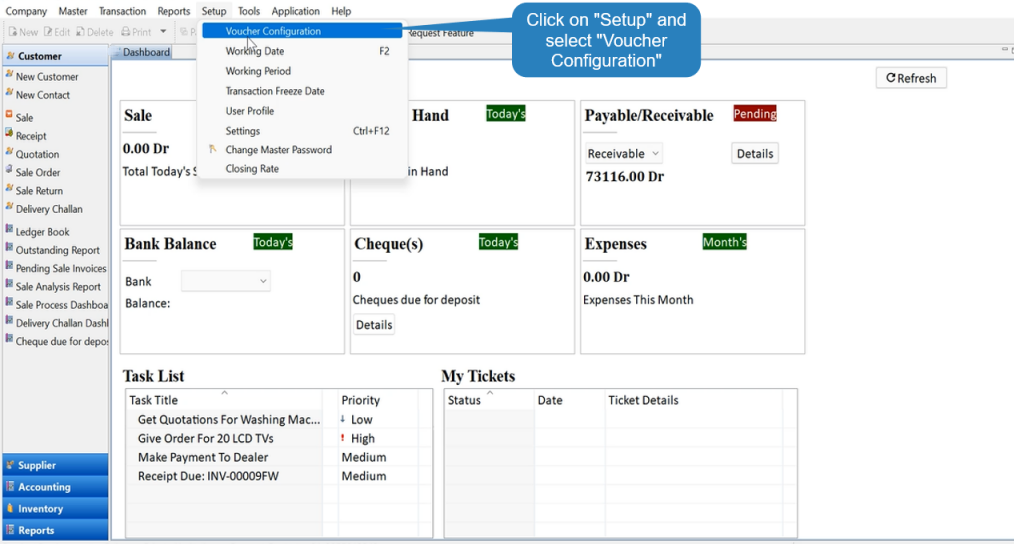

Step 3: To start voucher numbers from 1 go to Setup, Select Voucher Configuration and create new voucher configuration for new financial year.

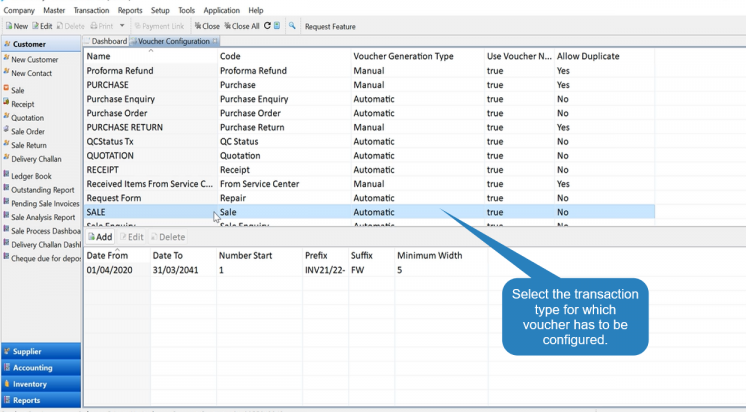

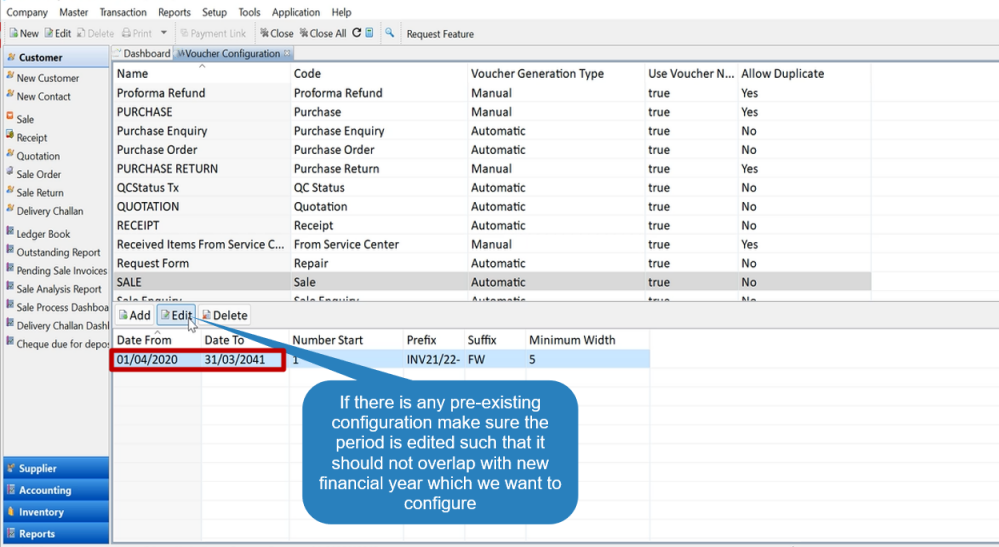

Step 4: Select the transaction for which voucher has to be configured. For example “SALE”.

Step 5: If there is any pre-existing voucher configuration, make sure that period (Highlighted in Red Colour) is edited such that it does not overlaps with the new financial year.

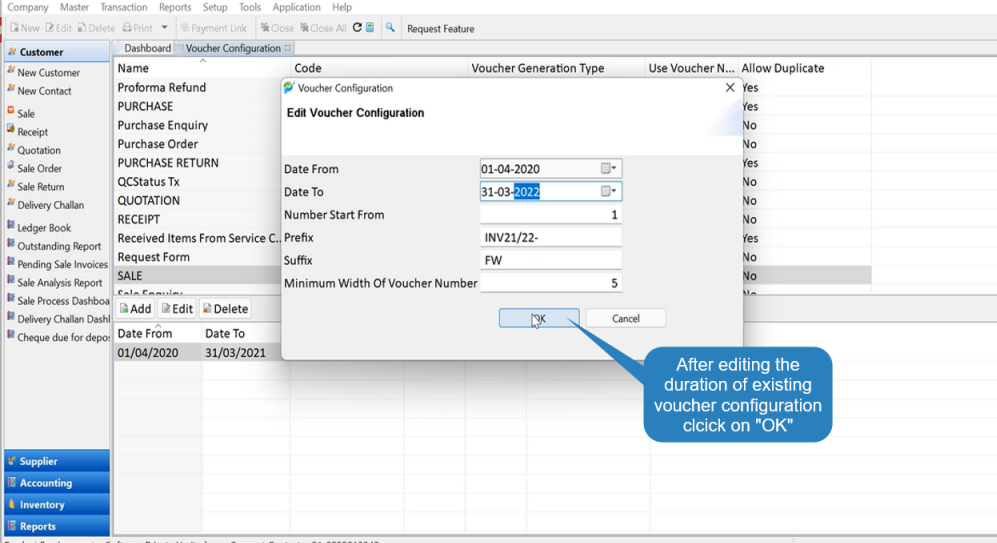

Step 6: Click on the “Edit” option and then edit the time period. Finally click on “OK” to save.

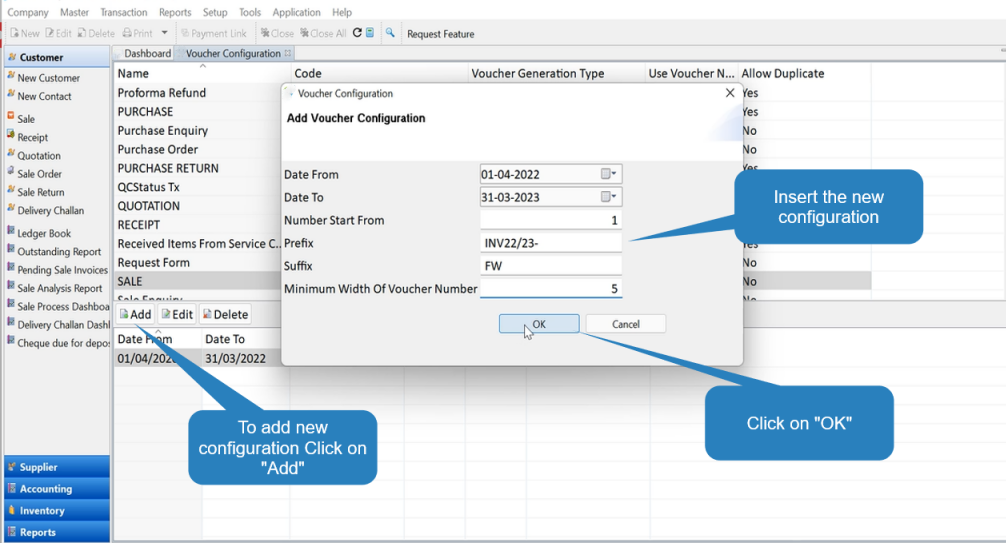

Step 7: After editing the existing voucher, click on the “Add” button to create new voucher configuration. Type in the Prefix, Suffix and Minimum Width of voucher. Click on “OK” to save.

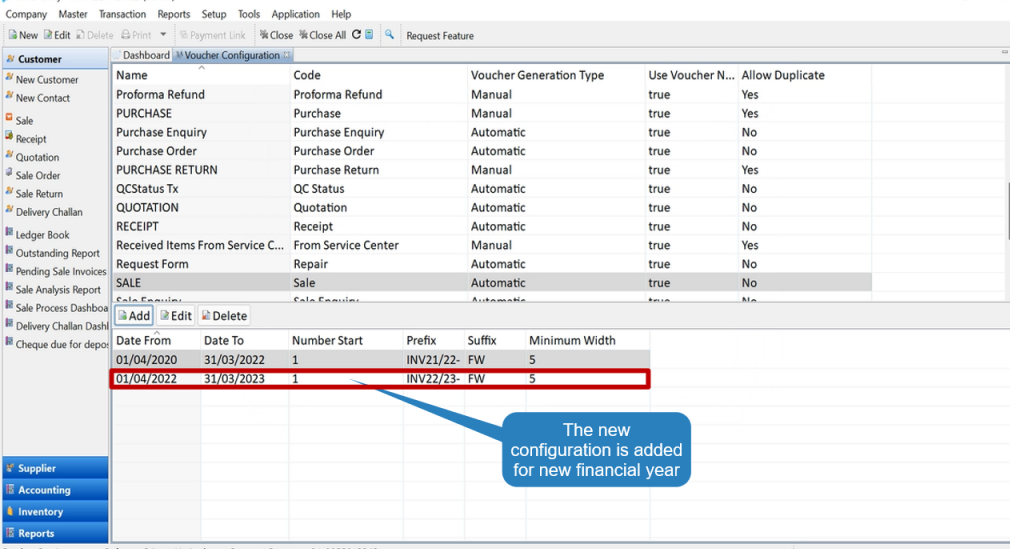

Step 8: New voucher configuration is ready and will automatically be used in the Sale Voucher now.

Follow the link to see video on voucher configuration:

Method 2: Create separate books for each financial year

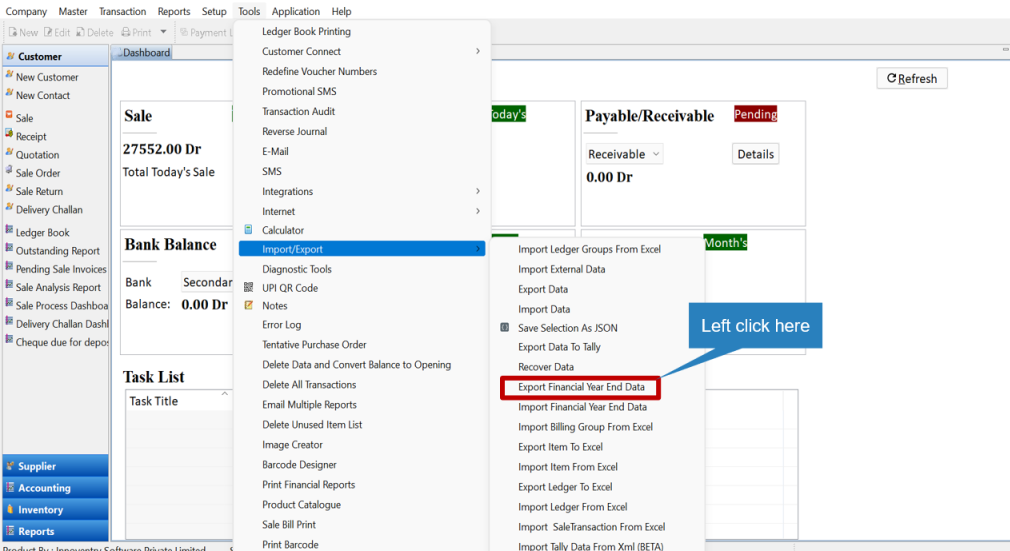

Step 1: Click on “Tools”, select “Import/Export” and then click on “Export financial year end data”.

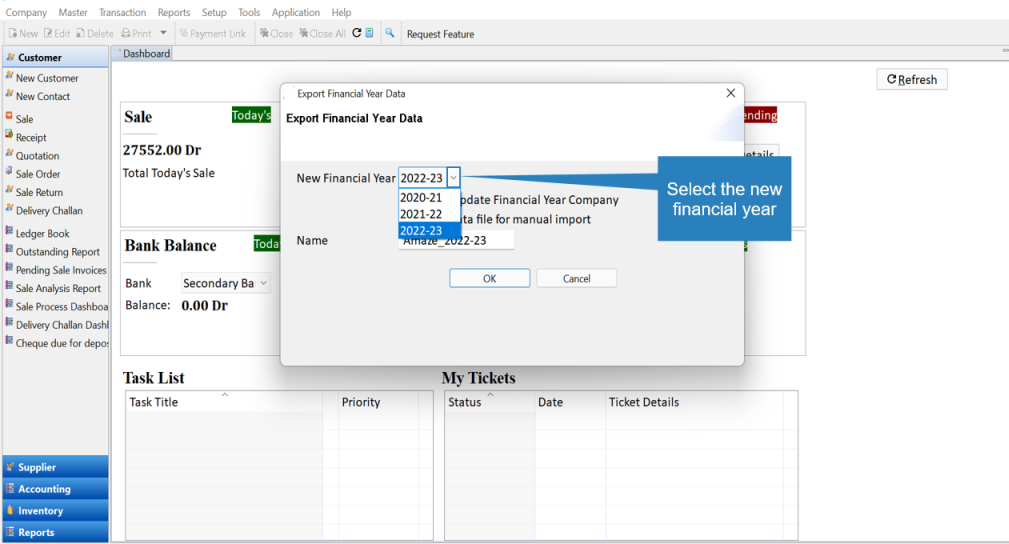

Step 2: Select the new financial year from the drop down list.

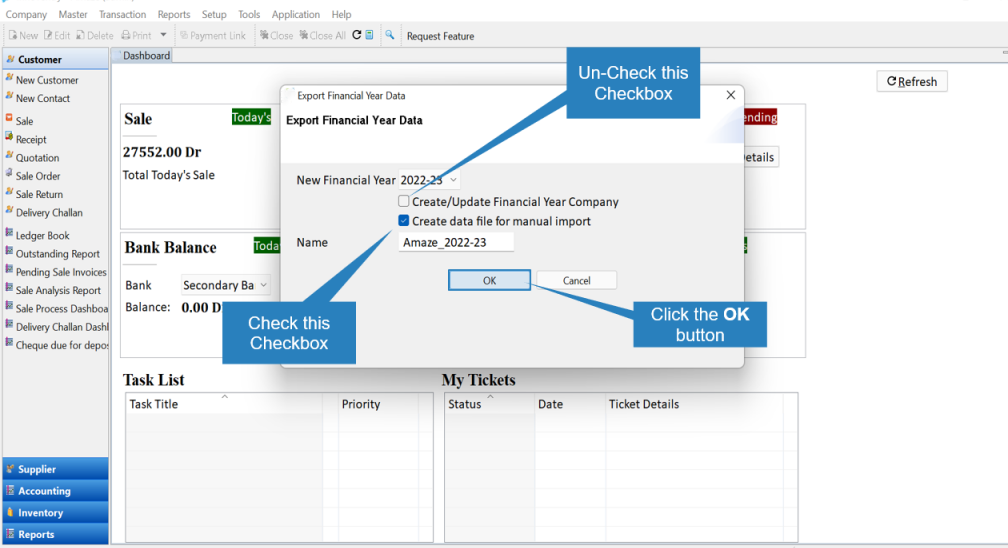

Step 3: Un-Check the “Create/Update Financial Year Company” and check the “Create data file for manual Import” option. Change name if required and finally click on the “OK” button.

After clicking on OK, it will take sometime to process as system is creating a new file with all existing items with their closing stock as opening stock and legers closing balance ad their opening balance.

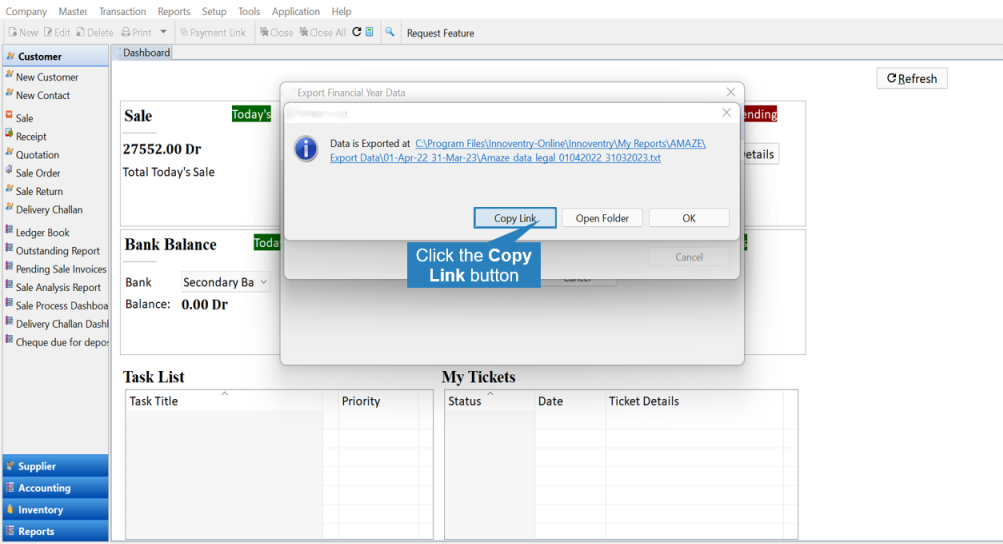

Step 4: Copy link using the “Copy Link” button.

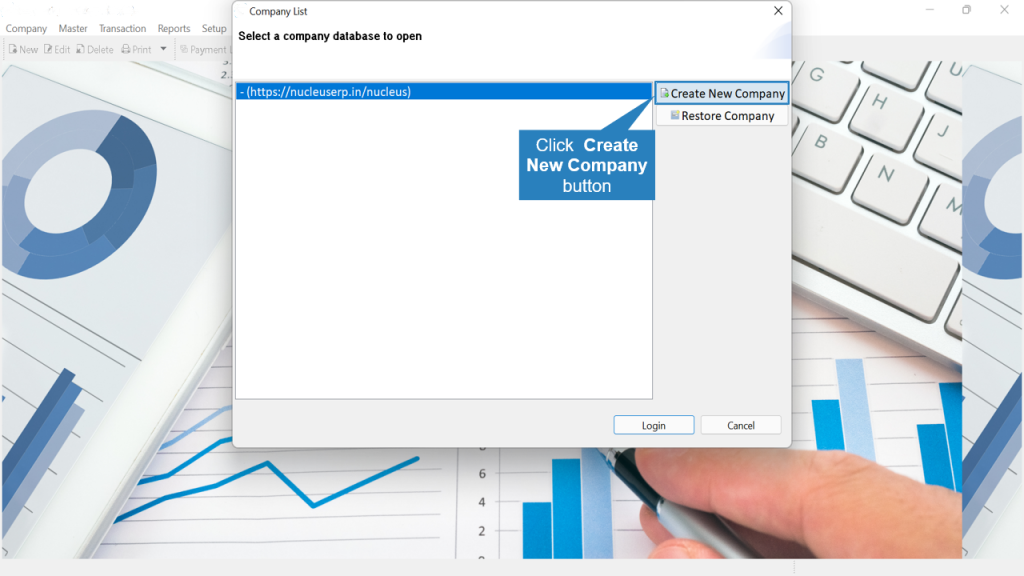

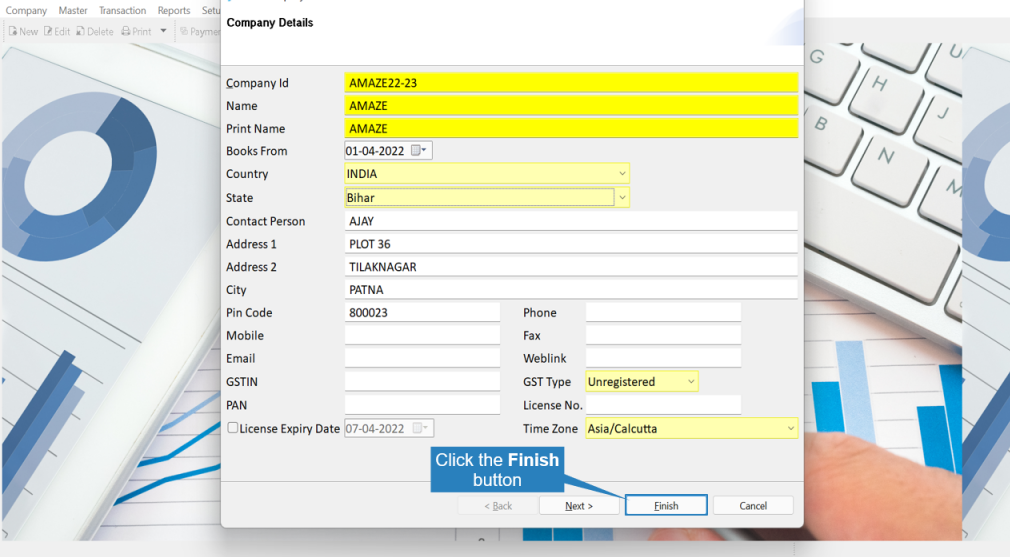

Step 5: Create a new company.

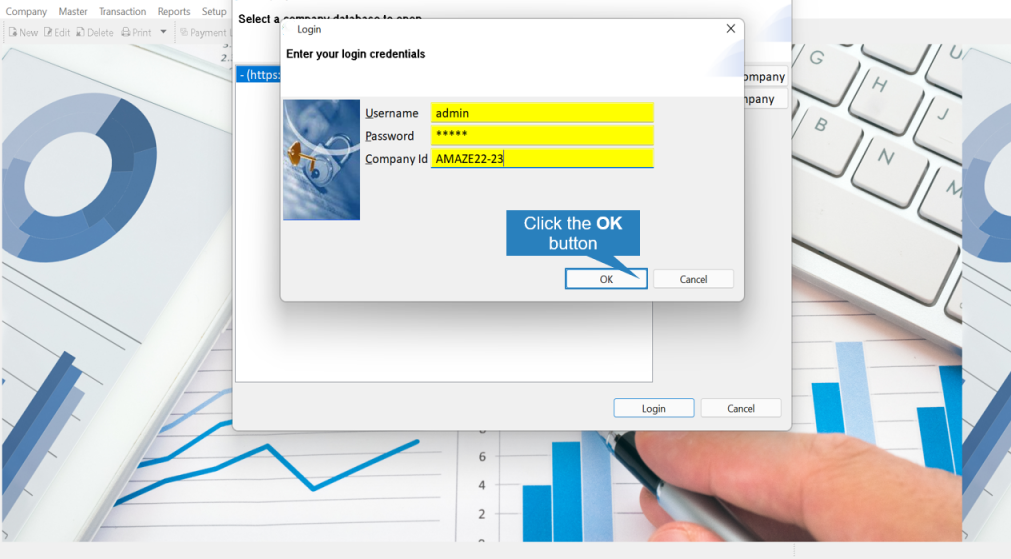

Step 6: Log-in with the new credentials.

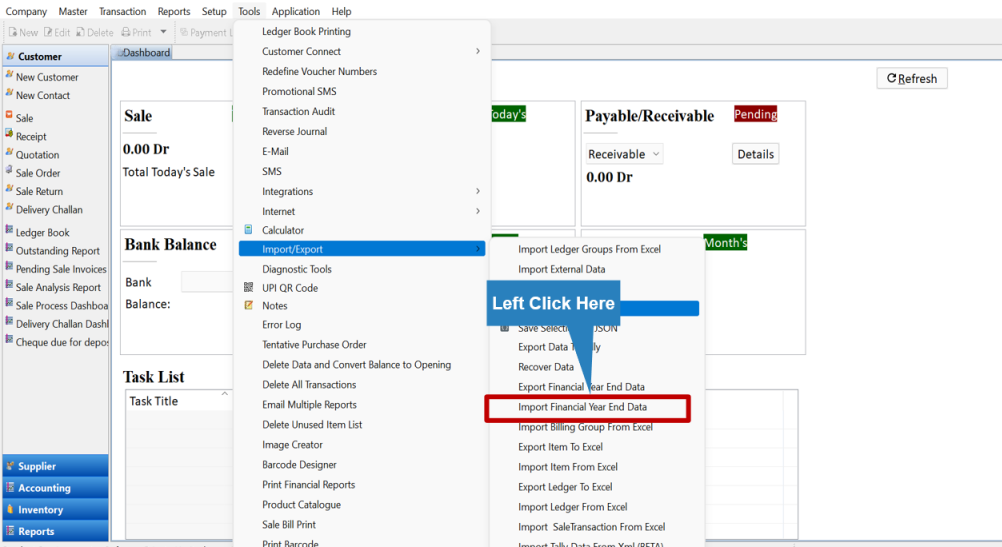

Step 7: Click on “Tools” option and then select “Import/Export followed by “Import financial year end data”.

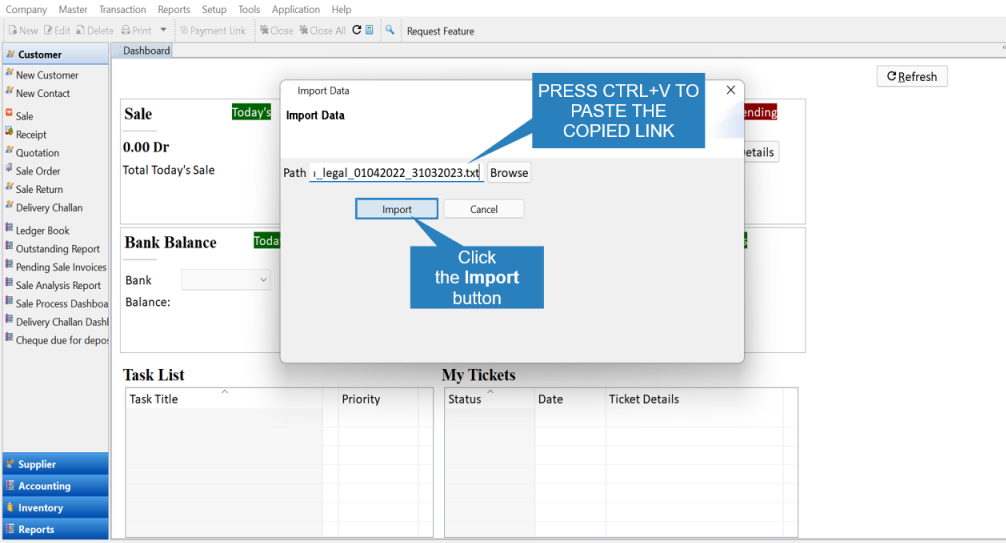

Step 8: Paste the copied link using “CTRL+V” button and click on the “Import” button.

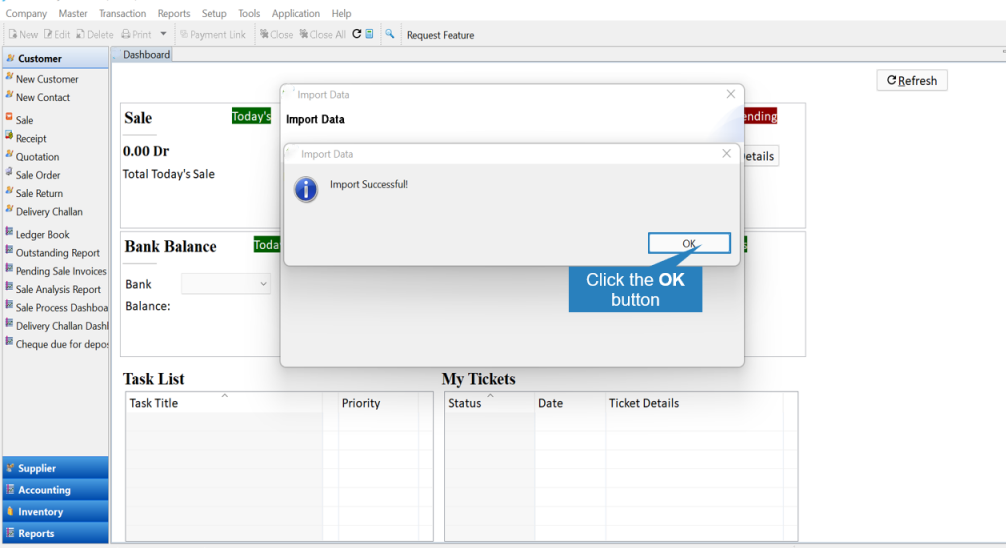

Step 9: The new financial year will be created. Now you will be able to work with new company. You can configure new voucher numbers as per your requirement. All existing items in previous financial year with closing stock are created as opening stock and legers with their closing balance as opening balance.

For any query Whatsapp or Call to 7887990033 or write an email to [email protected]