In usual retail business such as general stores, shoe stores, electronic shops dealing directly with the customers buying and selling commodities on credit is not a very common thing. Although, when dealing with mass buyers such as other subsequent businesses buying and selling on credit is pretty normal and quite few times is a necessity.

Your Comprehensive Financial Solution Taxperts Software

Blogs

Manage Pending Sale Invoices and Collect Payments

An invoice is always initially generated in a pending state. That means that the invoice has not yet been paid off but neither it is in a state past due. Most of the retail invoices that attempt collection with the account’s billing information will immediately move the invoice to a “Paid” or “Past Due” state, depending on the transaction result.

But invoices with manual collection such as in case of cash on delivery and where payment is naturally kept in pending state until the net-terms are reached are called to be “Pending” sales invoiced. Even if after reaching the net-terms the amount is not paid within the stipulated time period, usually called the due date, the sales transaction is called as over-due.

Managing the sales invoices is quite crucial as a business must be aware of the due dates to keep the business books proper and organized. Also some of the customers make a part of the payment at once and then make the rest at a later stage as agreed. Businesses must keep a track of such sales transactions and ensure that they aren’t a forgotten issue.

Creating a Pending Sales Invoice on Taxperts

The good news here is that the word “pending” added in front of the Sales Invoice does not actually affects how sales invoices are created in general. That is, Sales Invoices which generally are not paid instantly after generation, until certain terms are fulfilled are simply Pending Sales Invoices. So there’s basically only one difference. In general retail invoice we create the invoice and while it is being created the mode of payment and the amount is already fed into the invoice while generation.

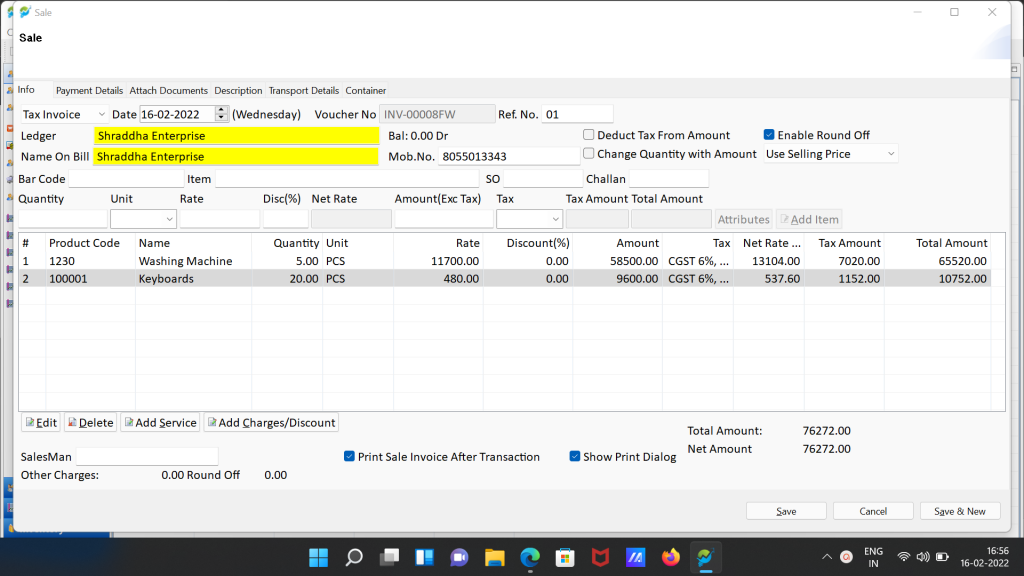

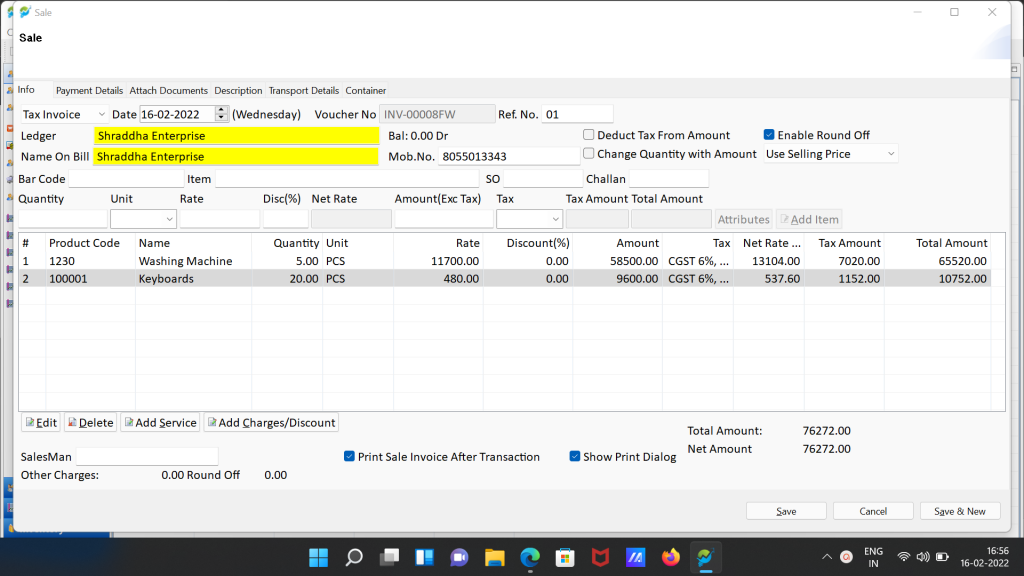

Creating a Sales Invoice on Taxperts as we already know is as smooth as butter. There are options to add all types of information feeding options in the sales invoice of Taxperts. There are an overall 6 tabs which can be accessed to input various details. The first being a general info tab in which we can input the ledger, contact details and the commodities with their prices.

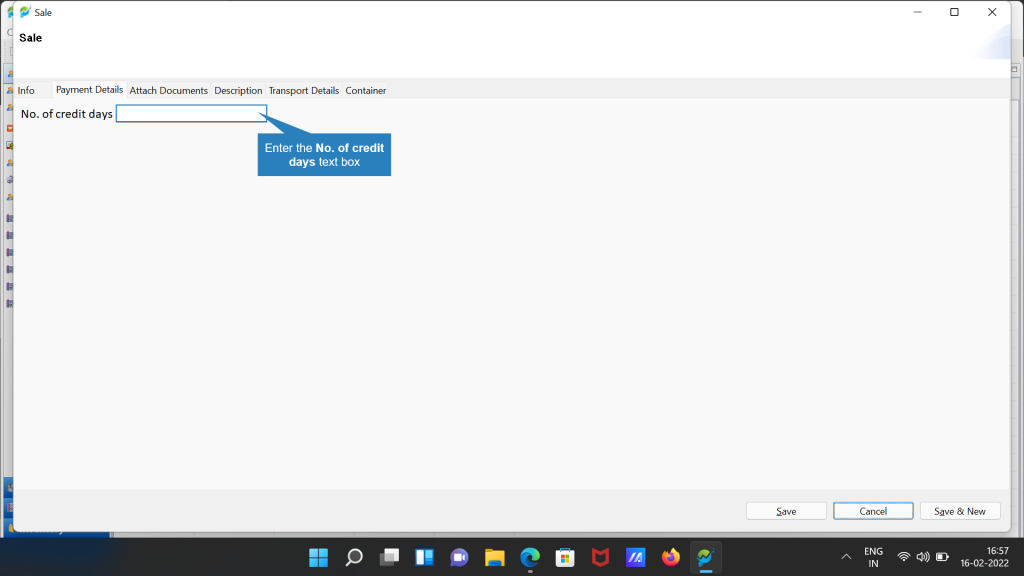

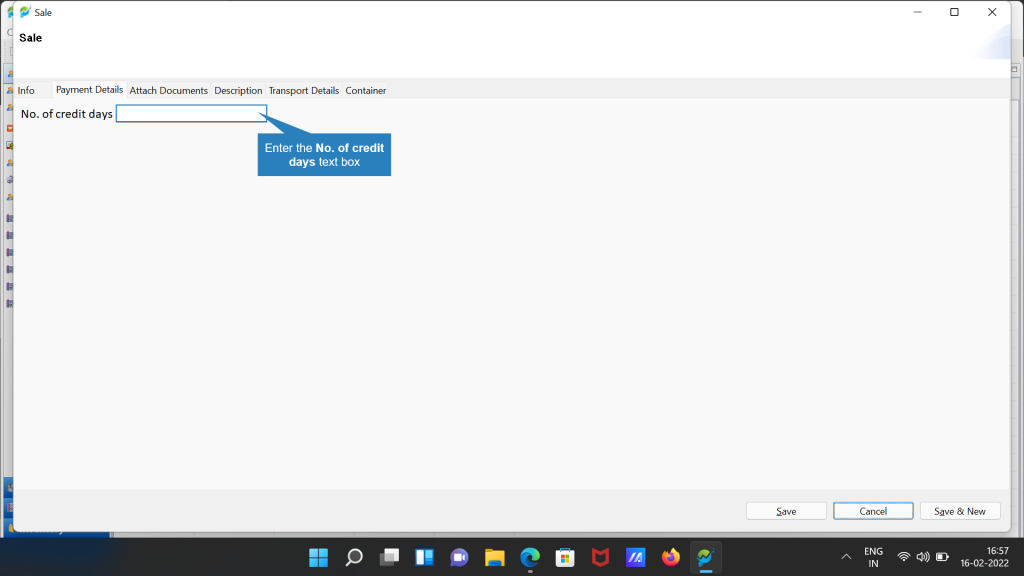

In the next tab the user can feed in the agreed “Number of Credit days”. Even if until the due date the payment in not received from the buyer the transaction is said to be overdue.

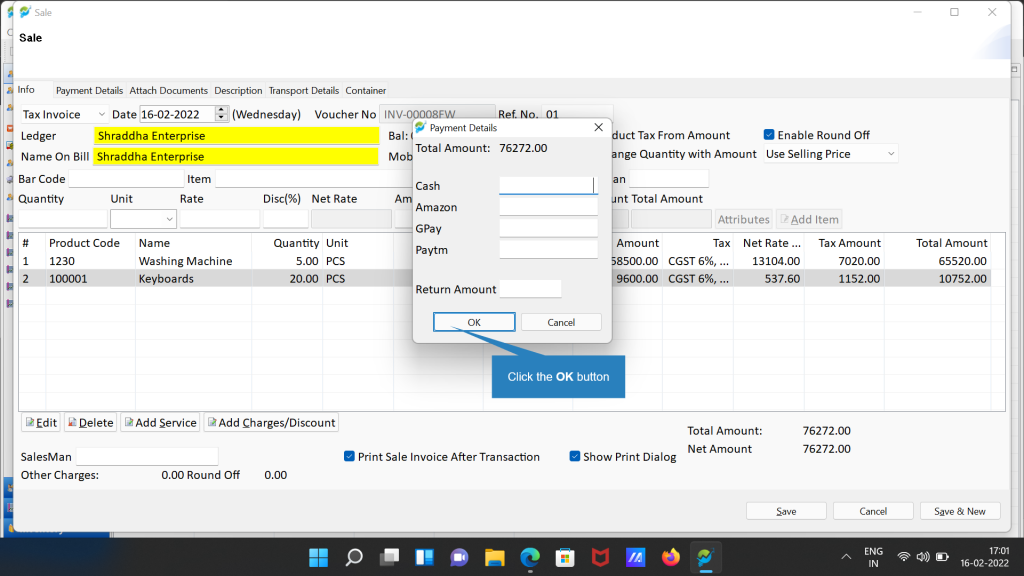

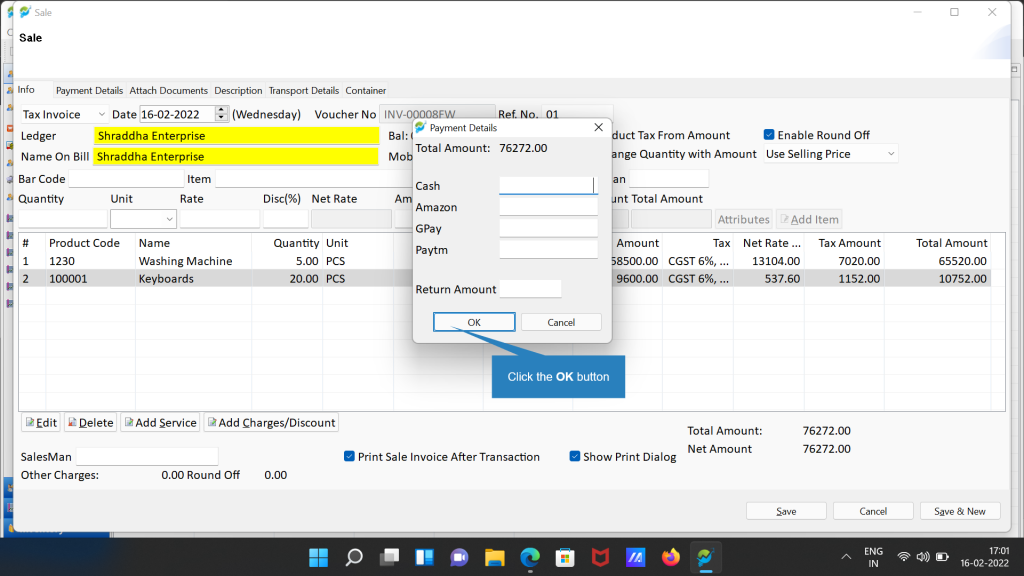

The user can also add all the information as appropriate according to the tabs such as Documents to be attached, Description, Transport Details and Container details if any. After feeding in all the details the user can click on the SAVE button and then a pop-up dialog to input the payment details pops up as shown in the below snapshot.

If there is no payment the payment detail is left blank and the user can click on the OK button to create a sales invoice without any payment. However, if there is any partial payment, the amount can be added as per the payment mode. Note that here payment from multiple modes for the same transaction is also acceptable. Hence the ledger and bank account for the selected payment mode is updated accordingly.

Managing Pending Sales Transactions

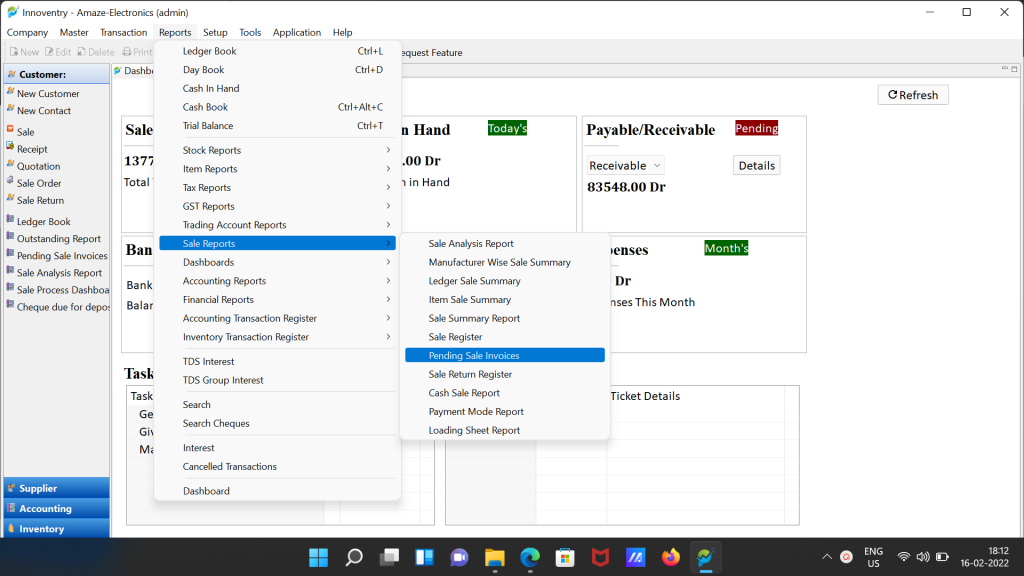

Taxperts never gives a chance to miss a pending sales transaction with a dedicated list of transactions with pending payments. The user can browse through the menu bar and hoover to the pending sales transaction dashboard.

Creating a Sales Invoice on Taxperts as we already know is as smooth as butter. There are options to add all types of information feeding options in the sales invoice of Taxperts. There are an overall 6 tabs which can be accessed to input various details. The first being a general info tab in which we can input the ledger, contact details and the commodities with their prices.

In the next tab the user can feed in the agreed “Number of Credit days”. Even if until the due date the payment in not received from the buyer the transaction is said to be overdue.

The user can also add all the information as appropriate according to the tabs such as Documents to be attached, Description, Transport Details and Container details if any. After feeding in all the details the user can click on the SAVE button and then a pop-up dialog to input the payment details pops up as shown in the below snapshot.

If there is no payment the payment detail is left blank and the user can click on the OK button to create a sales invoice without any payment. However, if there is any partial payment, the amount can be added as per the payment mode. Note that here payment from multiple modes for the same transaction is also acceptable. Hence the ledger and bank account for the selected payment mode is updated accordingly.

Managing Pending Sales Transactions

Taxperts never gives a chance to miss a pending sales transaction with a dedicated list of transactions with pending payments. The user can browse through the menu bar and hoover to the pending sales transaction dashboard.

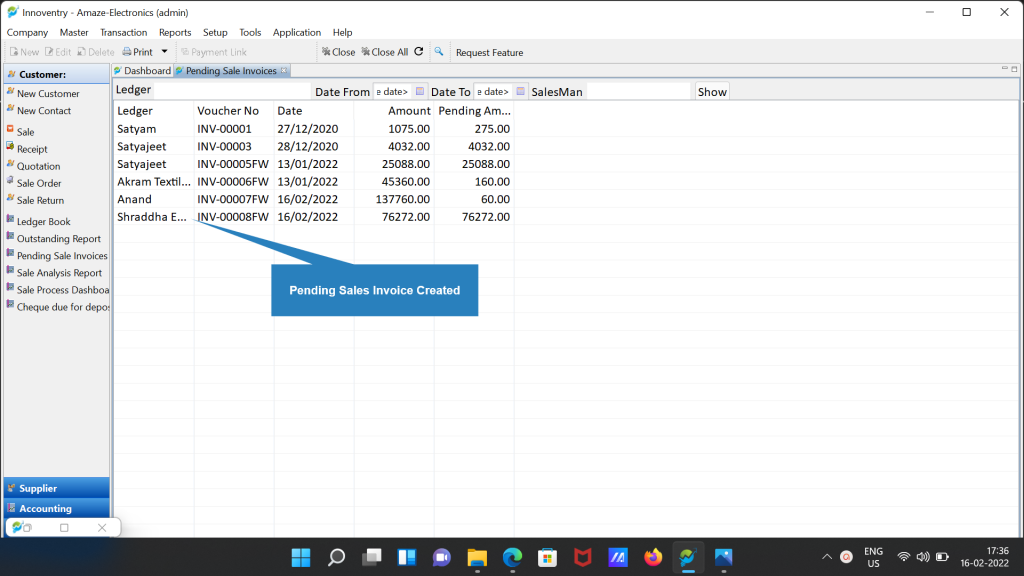

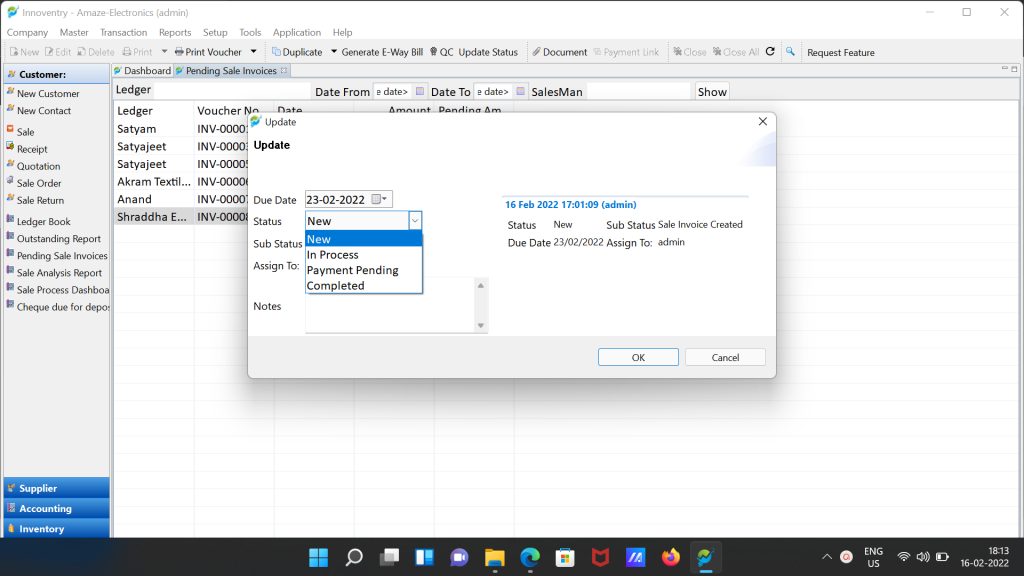

The presence of a dedicated dashboard alone sorts out various issues related with the management of the pending invoices. The dashboard shown below is configurated with various amazing and useful features as seen in the tools bar. The most important of them being the function to update status of the transaction.

The status can be updated in terms of the the stage in which the transaction already is. The status are:

- New: This status is automatically assigned to the transaction when the sales transaction is initially created.

- In Process: Assigned to transaction in case the transaction is in process. For example, if the commodity is shipped in case of cash on delivery order or in any other case as per the user.

- Payment Pending: This status is assigned in case the transaction is within the due date and the payment is still not received by the seller.

- Complete: This is the final status of the transaction and indicates that the commodity/service is already exchanged in lieu of the payment which has been received by the seller.

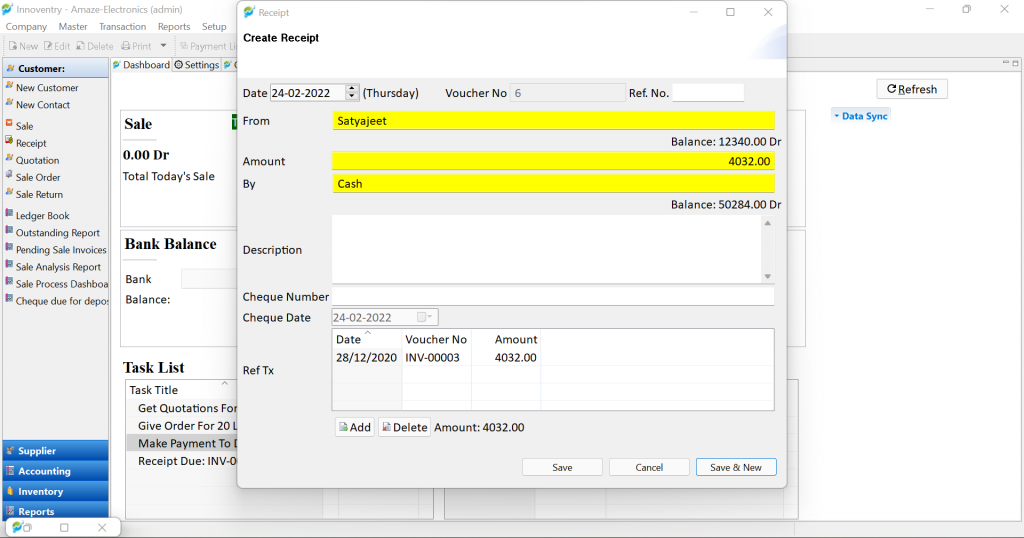

While receiving a payment from the customer the user can use the “Receipt” option in the software. The receipt option is used to enter any payment received with the reference to the invoice generated earlier.

For example, in the above snapshot, For a sales invoice dated 28-Dec-2020, we are making payment on 24-Feb-2022. The receipt feature shows all the pending invoices for the selected ledger. The billing person does not need to take the hassle of going through the ledger book. The software does that for him/her.

Also, to update any amount of payment received in case of wrong input for the transaction the user can use the “Edit” option in the tools bar after selecting the particular transaction. After this, the sale transaction window will open with the details and the user can feed in the amount received just like creating the sales transaction as per various payment modes. Once the amount received is equal to the invoice bill amount the transaction is automatically marked as complete.

So no more complications regarding pending payments and receivables due for the business. Easily update your ledgers and keep a clear account of the payments pending and payments received on your very own business buddy Taxperts.