Just like a normal person needs to buy commodities which makes their life profitable. A business also needs to buy commodities which it can use to sell forward and create a profitable business. Having a real and solid management for the same is a necessity which helps in varied ways. A better purchase process management keeps a check on the spending or rather rogue spending and other financial pitfalls.

Your Comprehensive Financial Solution Taxperts Software

Blogs

How to manage your Purchase Process?

So let’s understand what actually a purchase process is and what are the components involved in creating a wholesome purchase process. A purchase process is simply the step by step series of events leading to complete a purchase transaction by the business.

Technically it seems very simple and easy. But the actual technicality of it which a business faces is not that simple. The legal, professional and surreal aspect shall be maintained by the business to keep the business going in a state of bliss.

All the relevant legal step shall have a concrete evidence to keep an account of the flow and the process. Taxperts as a Billing, Accounting and an Inventory Management software helps you keep a track of the process and makes it quite easy to execute each step.

Purchase Process on Taxperts

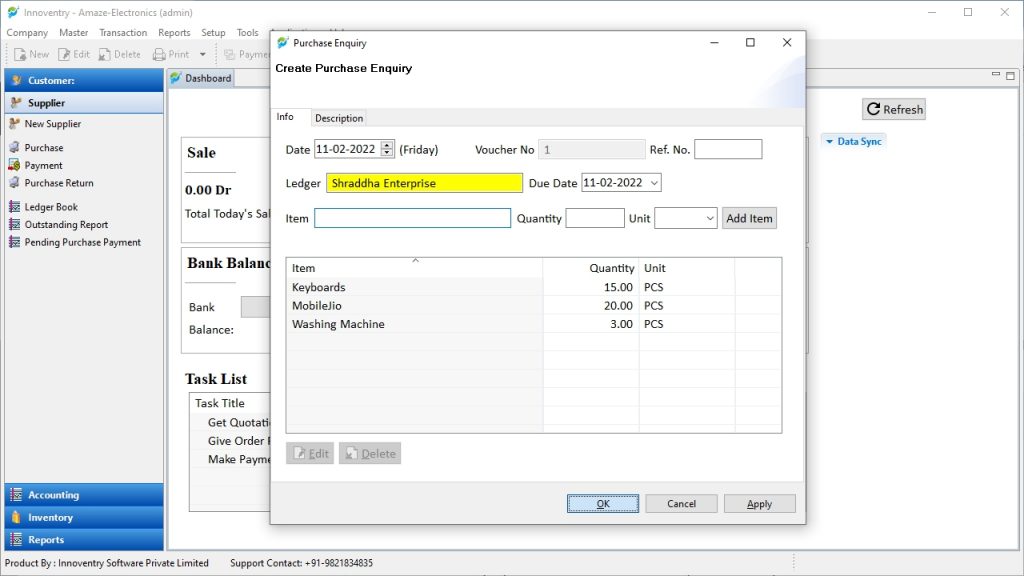

Need Analysis and Enquiry:

The first step involves finding the actual need of the business in terms of the purchase required by it. It works on analysis of requirement and the profitability of the commodity that the business intends to purchase or in other words “procure”.

After a proper analysis the business places a purchase enquiry with the dealer for the purpose of enquiry on the commodities that the business seeks to procure. A sales enquiry is quite a preliminary and crucial step towards the beginning of it. A purchase enquiry basically consists of the name of the item required and the quantity. Also a feature to add the description of the items required mitigate any of the discrepancies that may be assumed by the dealer.

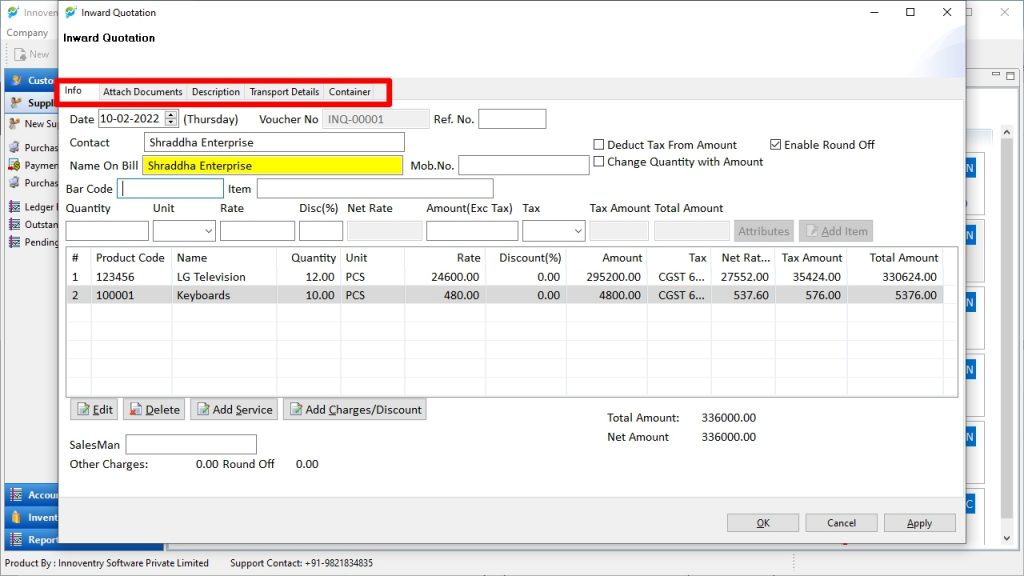

Purchase Quotation:

Post receiving the reply for the enquiry a purchase quotation is sent to the dealers or suppliers which clarifies the intensions of the business towards the procurement process. A good quotation shall be on point and have all the precise information and shall convey a proper intension of the business towards it. It shall consists of information such as the product and the amount that the business intends to spend on buying that item. Also Taxperts has given features where one can attach supporting documents which may be anything, from the tags or previous invoices. Also a proper description and transport details can be fed into the quotations as required.

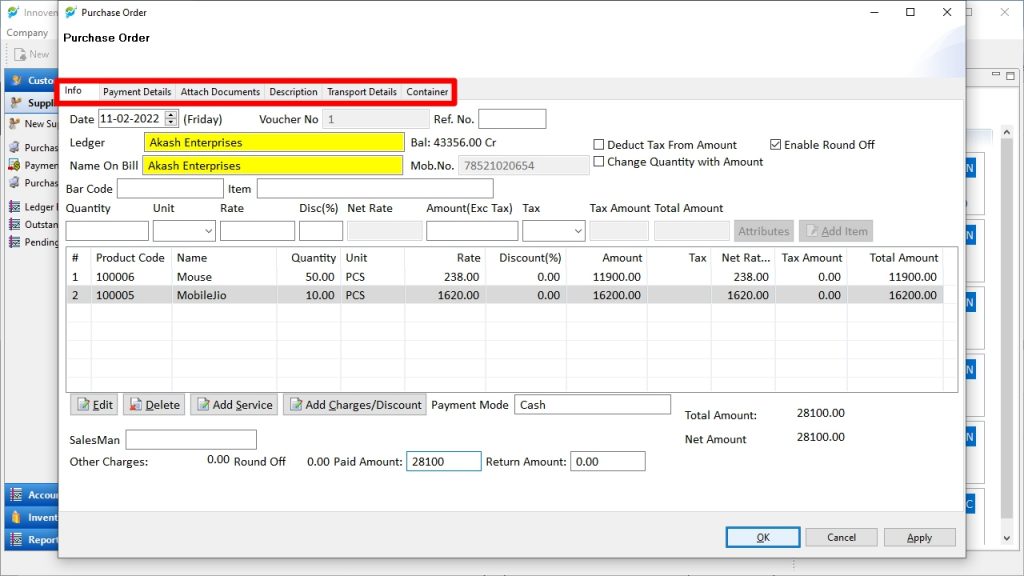

Generating a Purchase Order:

A purchase order (PO) is a commercial and legal document and the first official offer issued by a business to a dealer or seller, indicating the agreed price, types and quantities for products or services. It forms a basis on which the seller or dealer escalates forward the process. The document is a final and binding on the agreed price and quantity. It also should mention the payment method and any leeway of credit days if agreed upon. Taxperts here too has provided the feature to attach documents and add description with transportation details if required.

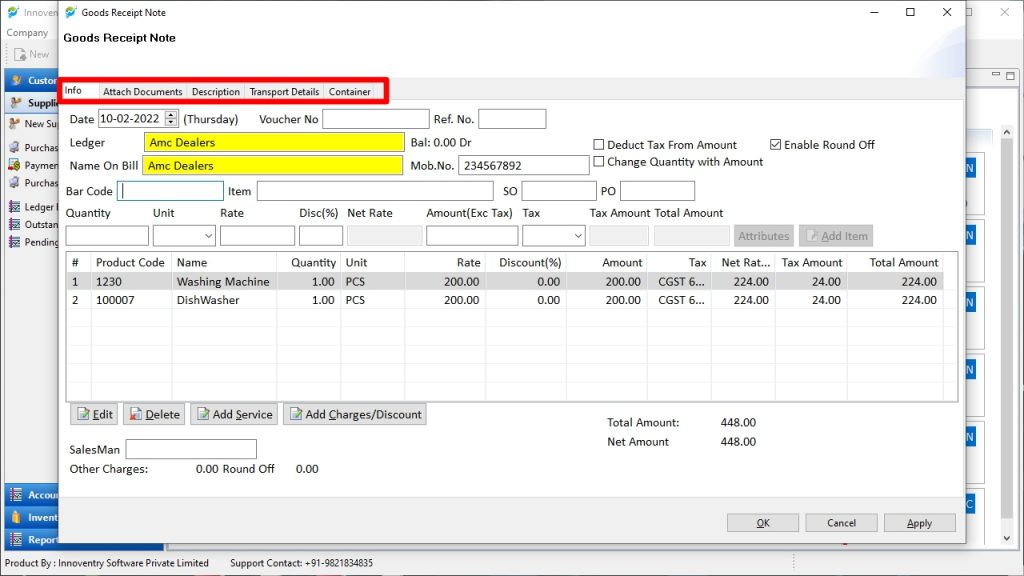

Issuing of a Goods Receipt Note:

Once the products are received. The business has to issue a receipt called the “Goods Receipt Note”. This is an evidence that the goods sent by the dealer have been received and one part of the transaction is complete. The note also states if any charge if incurred in the transportation of the goods. This note together with the sales order also forms a basis for the dealer/seller on which he can claim the money in the transaction.

Moreover..

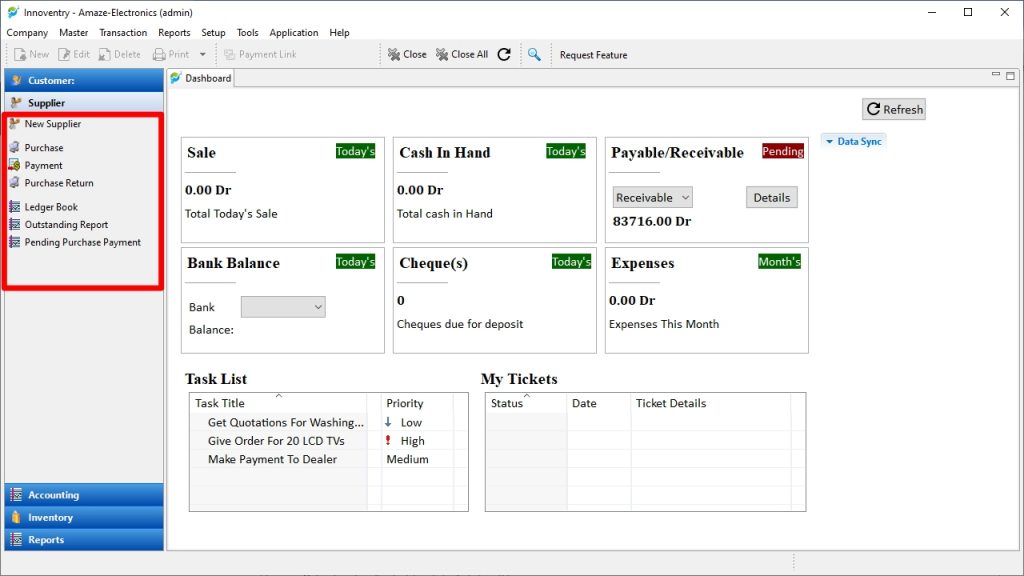

Taxperts provides you with all the required features and options to execute the process at one single section of the dashboard. All the major sales related steps can be processed from here itself.

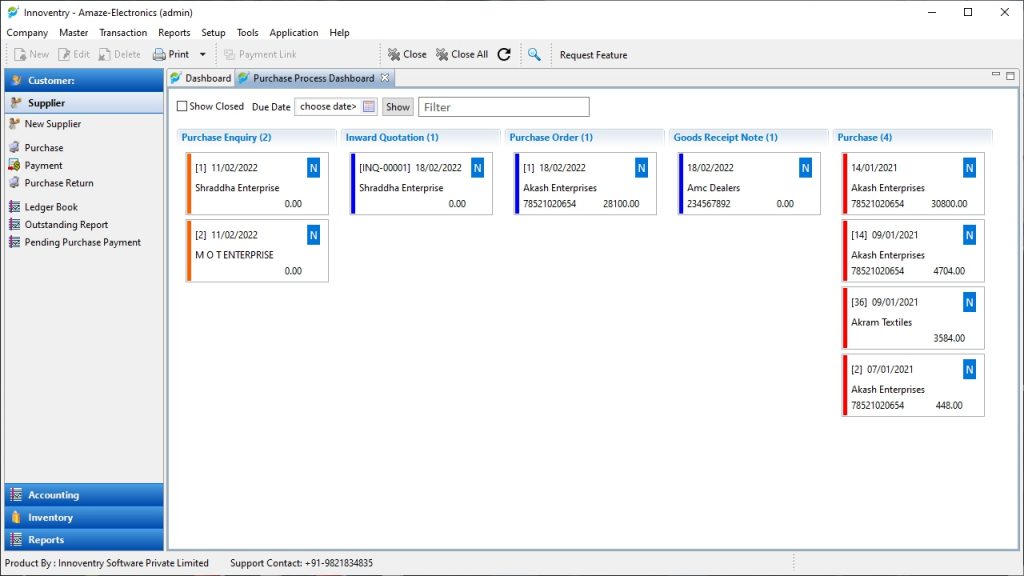

Also with the inbuilt “Purchase Process Dashboard”, the process can be viewed in a glance. The dashboard being dynamic in nature, users can update the status of all the steps and move it to the next step. No need to input all the details again and again which considerably reduces the chances to incur manual errors. Also the inputs shown on the dashboard are color coded in a way that the user can determine easily about the progress of the same, the stages of a particular transaction can be seen in the snapshot below.

Record keeping for businesses in todays arena of business environment no longer has the capability to sustain on only manual workflows and paper-based recordkeeping. For a optimum return and purchasing investment and strategical growth, automated and computer based methodologies and solutions like Taxperts are a must to mitigate such problems causing elements, that can cause a major harm to our exorbitantly dear business.